Our Investment in Waterplan

Climate Change and Water Scarcity

With record-breaking heatwaves and drought in the western US and Canada, it is clear that climate change is accelerating and that water is at its core.

Companies are struggling to adapt to climate change and mitigate water and climate risks.

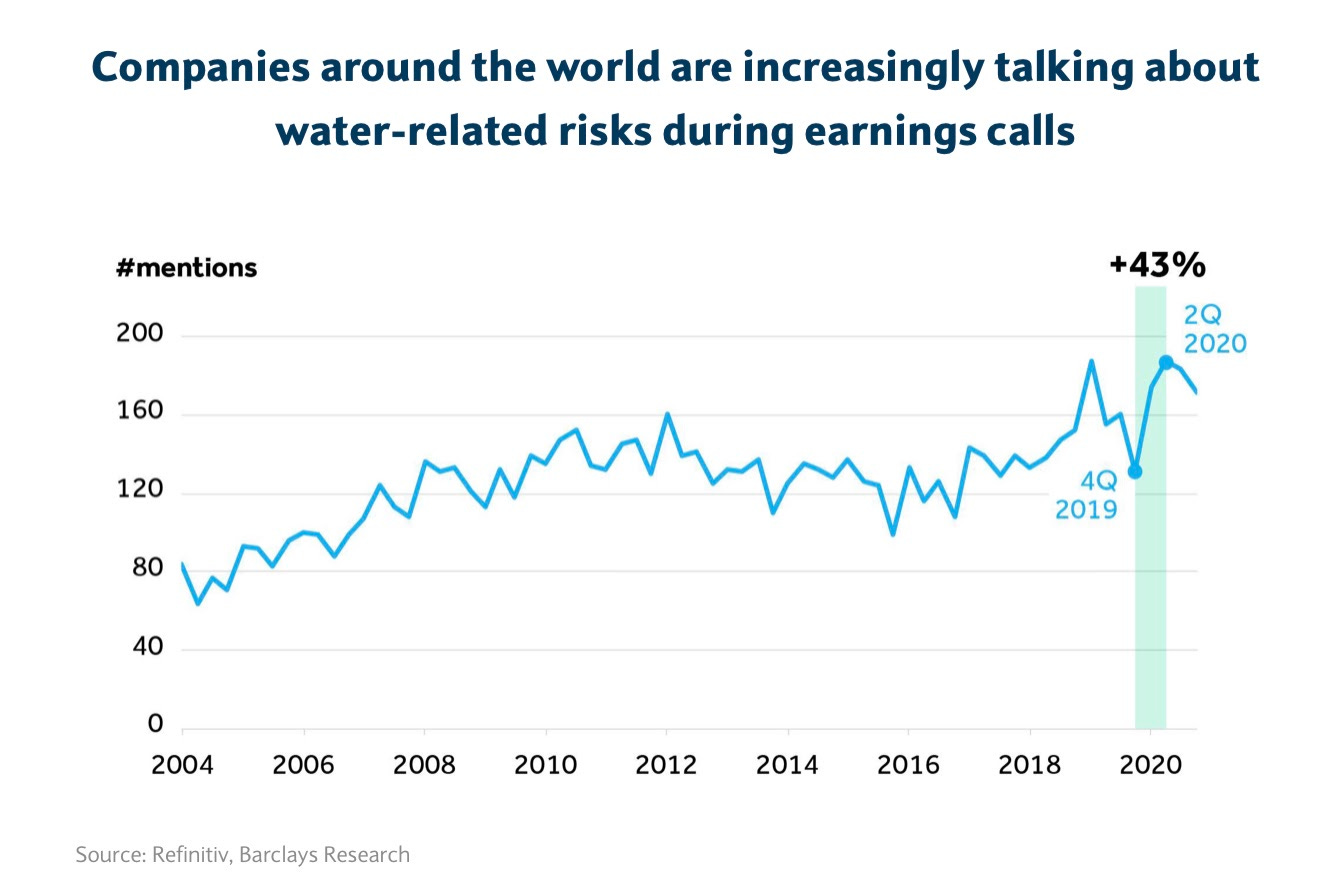

In 2019 alone, companies experienced up to 425 billion US dollars in financial value at risk globally related to water (according to CDP), and water was cited 43% more during earnings calls by firms globally in 2020 than in 2019.

Companies routinely disclose their utility bills, but it is likely they are understating the all-in costs of water use. Analysts estimate the true cost of water is three to five times greater than reported by companies.

Some of the biggest operators, including Colgate, Diageo, and Nestlé have made efforts to quantify the impact of water scarcity on their businesses, but many others have not.

If the true cost of water were factored across the industry, the profitability of some companies could theoretically be wiped out.

Climate change will also likely exacerbate water stress worldwide, as rising temperatures lead to more unpredictable weather and extreme weather events, including floods and droughts.

What is Waterplan?

Waterplan is providing businesses with critical insight into risks associated with the water security for their operations.

The platform combines companies’ operational data with local water satellite imagery to provide a real-time financial assessment of water risk (supply chain disruption, output losses, increase of production costs, etc).

Based on that, it offers tailored mitigation and adaptation opportunities, from conventional (grey) infrastructure to nature-based solutions.

By showing companies the business case for mitigating water risk, Waterplan will accelerate their transition to a world where companies are incentivized to save more water, abate the discharge of polluting effluents, conserve watersheds, and preserve shared value.

And directionally, it will not only help companies better identify water risks to avert unnecessary disruptions, but it will also help them single out design and implement sound solutions in the process.

If companies invest in reforestation in an area, for example, this may help accommodate runoff and potentially alter rainfall patterns for good.

Reason Behind Investment

Founder Fit

Waterplan was founded by a team of tech and water second-time entrepreneurs with two exits and almost ten years of experience working for Fortune 500 companies in water projects.

The founders met over five years ago, working together at the Global Shapers Community of the World Economic Forum.

Jose has been a part of the MCJ community for more than a year now, and it was in the community that he met Mike Olson (one of their main advisors, and MCJ Collective LP!), and where the initial idea for Waterplan started to take form.

Nico is a domain expert in the area and a medical doctor, who started treating waterborne diseases and ended up bringing safe water access to more than 300k people worldwide.

After Jose’s previous B2B SaaS company was acquired, he decided to join forces with Matias and Olivia (also tech entrepreneurs) and combine their tech and water expertise to create a tech company to accelerate water risk mitigation.

Advisors include Greg Koch (former Senior Director, Global Water Stewardship at The Coca-Cola Company), Gonzalo Delacámara (Senior Policy Advisor to the European Commission, UN, OECD, World Bank Group), Mike Olson (Cloudera founder), Kari Vigerstol (Director of Water Security and Innovation at The Nature Conservancy), Benjamin Zaitchik (Associate Professor at Johns Hopkins University, Department of Earth and Planetary Sciences), Paul Fleming (Former Global Water Program Manager Microsoft), and Will Sarni (Founder and CEO at Water Foundry)

Tackling an Important and Underserved Risk Area

For the aforementioned reasons, water risk will be an area of growing importance. We believe it will follow a similar trajectory as carbon accounting, in which more and more companies will be forced to pay attention to it, for risk management, due to social pressure from employees and the marketplace, and due to increasing regulations from governments as this issue continues to get more pronounced.

Conclusion

Less than a year since its founding, Waterplan has secured multinational customers like McCain, Henkel, San Miguel, and Facebook, and already has several hundred grand in booked ARR. They are signing on new customers every week, and we believe this will only accelerate as the importance of water and water-related financial risk continue to come to light.

You can read the rest of “Why we invested in” collection here:

Comments (0)

There are no comments yet :(